Interview with Seattle Times

Seattle, Washington

It’s not that you are exactly overburdened with trust for your local savings and loan, after all the bad-loan-and-bailout scandals.

But Katherine Neville is likely to make you cast a jaundiced eye over the entire banking community.

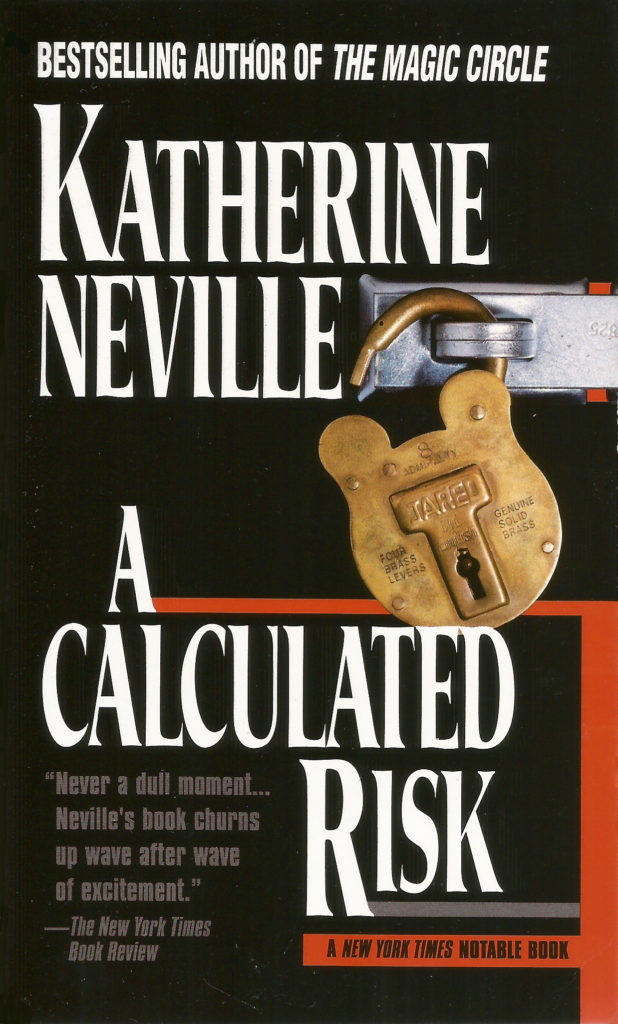

Her new book, “A Calculated Risk” is a caper novel with a feminist heroine who knocks off the fictitious Bank of the World in an electronic scam, just for the fun of matching wits with her former mentor and lover. (Well, also the fun of making $3 million, by “borrowing” a billion electronically and investing it for three months.)

What’s likely to make you nervous about this is how plausible it all seems. And one reason is Neville’s background in computers and banks: A former Bank of America vice president, she also helped design computer systems for the Algerian government, OPEC, IBM, Honeywell, Deutsche Bundesbank and the New York Stock Exchange.

Several years ago, Neville began toying with the idea of dropping the number-crunching in favor of the novel. She actually began plotting “A Calculated Risk” in 1980, and started writing the first draft in 1984, at the same time she was working on her first published novel, “The Eight.”

“It’s a good thing ‘A Calculated Risk’ didn’t come out sooner,” Neville said yesterday during a stop in her promotion tour.

“Otherwise, no one would believe the BCCI international banking scandal didn’t get the idea from the book, just the way the Hunt brothers went after the silver market after Paul Erdman’s ‘The Silver Bears’ came out. Everything the villains in my book do, the BCCI conspirators did — and they got caught too.

“What makes me angry is that there are still no regulations in banking that prevent the misuse of money. Regulations definitely are needed.”

Neville’s heroine, Verity Banks, is smarter than most of the men around her, but finds her career stalled by a boss who can’t get past the fact that she’s a woman. That happened to Neville more than once. Is she getting even with some of her former colleagues in this book?

“Well, I’d say the three villains are composites of many, many colleagues, I’ve tried not to base one single character on a single person. Many of the people I’ve worked with have been very intelligent and very good at their jobs.

“But I’ve had my share of . . . rapscallions.”

Her new life as a novelist, in high gear since the appearance of “The Eight,” suits Neville much better than her years in banking and electronics. Ironically, all that experience as a computer whiz didn’t stop her computer from “eating the last chapter of this novel,” as she puts it. It took 48 hours on the hotline to hardware and software manufacturers (each of course blaming the other) before the blame was finally fixed on an obsolete operating system that had been installed in the computer by mistake. The last chapter was finally recovered.

The new “A Calculated Risk” is less of a sprawl than the vast complicated “The Eight,” in which Russian chess masters and assassins and magic potions and 19th century French nuns and Napoleon and the long-lost chess service of Charlemagne are floating around in an immensely complex fictional stew.

But the plot of the new novel is still likely to keep you hopping, following the high-tech derring-do from San Francisco and New York to a Greek island that’s one of the keys to the scam. Neville’s eyes light up when she discusses the fun she had writing this one — and plotting the next book, which will be set between World Wars I and II.

Meanwhile, the bankers keep coming up to her at book-signing events in stores and malls.

“They all want to know, is this more fun than banking?” Neville confesses.

“Yes! Fiction is better than reality.”